amazon flex driver tax forms

Report Inappropriate Content. Or download the Amazon Flex app.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

The FTC is sending payments totaling nearly 60 million to more than 140000 Amazon Flex drivers who had their tips withheld from them by Amazon between 2016 and 2019.

. Do i need LLC to be amazon flex driver. Click Download to download copies of the desired forms. That means you have to pay self-employment tax.

Driving for Amazon flex can be a good way to earn supplemental income. Below is an example 1099 form with total earnings of 5500 noted in BOX 7. Select Sign in with Amazon.

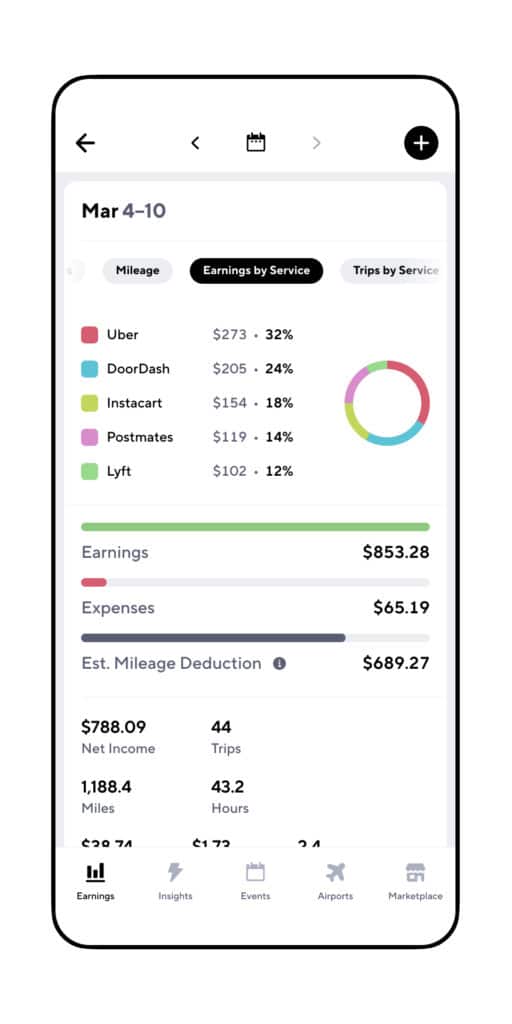

12 tax write offs for Amazon Flex drivers. As an independent contractor you will use the information on form 1099 from Amazon Flex to complete Schedule C and Schedule SE which in turn are needed to complete sections of Form 1040 that pertain to your Amazon Flex earnings and tax amounts. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Increase Your Earnings. Schedule C is included with and part of your personal tax return Form 1040. Most people pay 153 in self-employment tax.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. You can report your self-employment income and expenses on a Schedule C using your own Social Security number.

Tap Forgot password and follow the instructions to receive assistance. Become a Delivery Driver. Take advantage of tax write-offs.

5y New York. No matter what your goal is Amazon Flex helps you get there. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

You are required to sign your completed Form W-9. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. Op 4y Virginia Beach Logistics. Self-employment taxes include Social Security and Medicare taxes.

Box 80683 Seattle WA 98108-0683 USA. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. The agency urged affected Amazon Flex drivers to deposit or cash their checks before Jan.

The 153 self employed SE Tax is to pay both the employer part and employee. Choose the blocks that fit your schedule then get back to living your life. A 1099 form is a series of documents the IRS calls an information return defined as a tax return that contains taxpayers identifying information but does not state their tax liability.

Report Inappropriate Content. Get it as soon as Wed Feb 23. The IRS requires that Amazon obtain your consent to sign your tax identity document electronically.

1099 Forms Youll Receive As An Amazon Flex Driver. 7 2022 and said that drivers who receive more than 600 will receive federal tax forms to report the. Knowing your tax write offs can be a good way to keep that income in your pocket.

Sign in using the email and password associated with your account. Amazon Flex drivers are independent contractors. 46 out of 5 stars.

Make estimated tax payments. Start a package delivery business. Click ViewEdit and then click Find Forms.

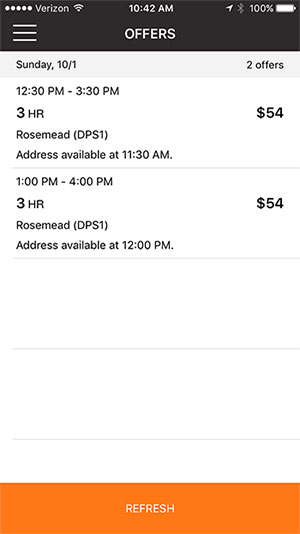

Most drivers earn 18-25 an hour. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. You can plan your week by reserving blocks in advance or picking them each day based on your availability.

Here are four steps to help guide you through the process and help ensure accuracy while maximizing your return. Amazon Flex quartly tax payments. We would like to show you a description here but the site wont allow us.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Ad We know how valuable your time is. Actual earnings will depend on your location any tips you receive how long it takes you.

Youll also pay income taxes according to your tax bracket. Tax Identification Information Invalid. With Amazon Flex you work only when you want to.

Gig Economy Masters Course. Select the right tax forms. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC 25 Pack.

With the Bonsai. With Amazon Flex you work only when you want to. If you do not consent to electronic signature you must mail your hardcopy W-9 to Amazon at.

Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers. We know how valuable your time is. No you do not need to be an LLC.

You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Whatever drives you get closer to your goals with Amazon Flex. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes. Im in NYC and havent got it too. Its almost time to file your taxes.

The FTC brought a. 1099 MISC Forms 2021 4 Part Tax Forms Kit 25 Vendor Kit of Laser Forms Designed for QuickBooks and Accounting Software 25 Self Seal Envelopes Included. Let Bonsai Tax Handle Your Amazon Flex 1099 Forms And All Other Self-Employed Taxes.

Sign out of the Amazon Flex app.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

The Best Ways To Track Gig Driving Miles For Taxes Gridwise

How To File Your Uber Driver Tax With Or Without 1099

Smart Money Podcast Money Check In And Finances Abroad Nerdwallet Smart Money Podcasts Finance

How To Do Taxes For Amazon Flex Youtube

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tracking App Tax Deductions Mileage

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Doordash Driver Canada Everything You Need To Know To Get Started

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver